Are you seeking for a way to improve your credit history in excess of the following couple of months? Are you anxious that purchasing a auto will be much more complex with your very poor credit rating? If so, then you need to discover all about how to get a automobile title financial loan to boost your credit history.

If you use just a little method and intentionality, a title loan may finish up strengthening your credit score dramatically.

It enables you to consider again manage of your situation.

See underneath for an in-depth guide on how you can get a vehicle title financial loan that will aid you get your credit score rating back to the place it should be.

What is a car title loan Title Financial loan? You know how the old stating goes, "Do not make investments in anything at all you do not truly comprehend." This is sound suggestions for avoiding sophisticated financial situations that may possibly do more harm than very good.

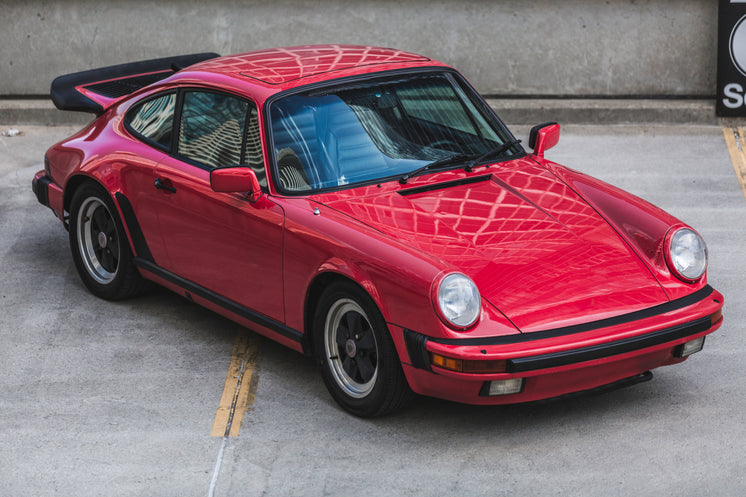

Thankfully, vehicle title loans are an effortless-to-realize instrument at your disposal. As the identify would suggest, a vehicle title bank loan is a form of income advance that uses your auto title as the collateral on the financial loan. The benefit of your car will impact how a lot you could possibly acquire in a vehicle title mortgage.

The advantages of a auto title bank loan are significant. First off, you're authorized to drive your automobile as you generally would, even when the financial institution has your title.

Next, the approval process is rapid and productive, and it doesn't call for you to have a strong credit rating rating. A automobile title bank loan can also help you consider back again management of your economic situation you can get the income you need to pay off charges or debts, then shell out it back again with time on your facet.

With the proper automobile title loan lender on your aspect, you will be able to use it for strengthening your credit rating or spending off unforeseen expenditures.

How to Obtain a Car Title Financial loan If you're heading to use a auto title bank loan to increase your credit rating, then you require to focus on discovering the correct auto title mortgage loan company for the work. Performing so can give you much more self-assurance in the method as a complete.

Be positive to appear into the software procedure. We have a simple a few-action process that makes it possible for you to get your a lot-needed money all the faster.

1st, you just need to use on-line or by emailing us at [email protected].

We just need information this sort of as your entire name, e mail, cellphone number, and requested loan quantity. For vehicle information, we just call for the make, product, yr, trim, and mileage. It will take sixty seconds to fill out if you have all this information handy.

Right after we obtain your software, we'll determine how a lot we can lend you, then ask for that you ship above all of the needed paperwork.